Microfinance Marketplace

Participate for Making Real Impact with Funding at Amartha

Start earning weekly passive income by utilizing funding for the preferred micro businesses

Start Funding

Empowering rural micro businesses, accomplishing better Prosperity for Indonesia

Earn Weekly Passive Income

Earn passive income through earnings in weekly periods. Micro business funding starts from IDR 100.000, get return of investment up to 15% flat per year.

Calculated Risk

Amartha utilize a credit scoring system with machine learning for more accurate measurement of investment risk. Amartha also implements joint liability system and officially licensed and supervised by the The Indonesia Financial Services Authority (OJK)

Social impact

Amartha provides business funding for micro business development in more than 35,000 villages and contributing fair sharing of benefits through women's empowerment all at once.

Trusted and guaranteed funding through Amartha

Financial Calculator

Emulate funding and project profitability

Calculate the return that is obtained by making impact investing for micro businesses through Amartha. Forecast the weekly return and calculate the annual compounded return over time. Important to know. Learn how Amartha manages funding risk here

Let's start funding the preferred micro business with Amartha

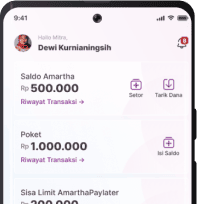

Download and Register

Download the Amartha app, fill the data, upload the requested documents and wait for the verification to complete the process

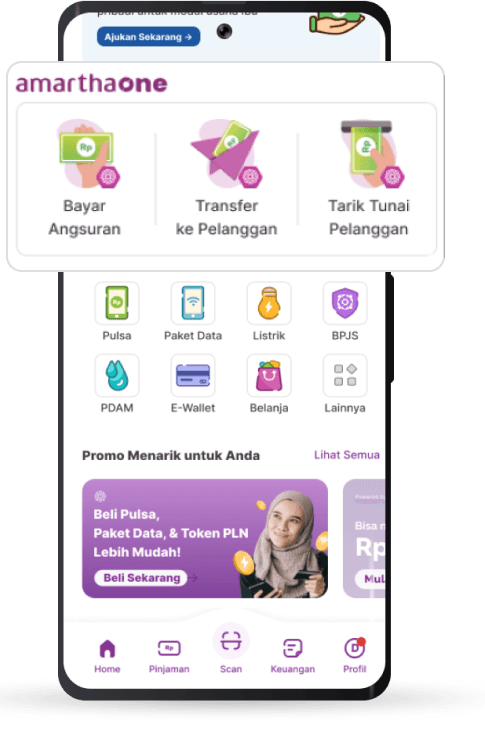

Choose Borrower

Click the 'Marketplace' menu in the app then review the borrower profile for funding. Explore the A-E credit score options with various percentages of return, business sector, business locations, tenors and types of impact.

Complete Payment

Make payments using the Amartha account balance or top-up the balance using e-banking or e-wallet option

Receive installments

Review the borrower payment performance through the 'portfolio' menu. Installment payments will be added immediately to the Amartha account balance

What do they say about microfinance funding with Amartha

Popular Questions about Microfinance Funding

How can I review the borrower's timely repayments?

Lenders can always review it in the Amartha app under the "portfolio" menu. Find the consistent payment status, the remaining principal balance and the total return per borrower that has been collected. If new funding occurs, you can also find the latest status here.

Why are there failed funding disbursements to the borrower side?

This could be due to the selected borrower withdrawing from the funding application, or, if you fund through a crowdfunding scheme, perhaps the funding target is not met by the specified deadline.

How does Amartha calculate borrower loan risk?

Amartha uses data-driven risk profiling technology for any collected data processing including: demographics, business and family status, funding history and psychometric-emotional assessment.

How many borrowers can I fund?

There is no limit of how many borrowers can be funded. Lenders can directly choose borrowers under the 'marketplace' menu in the Amartha app and make payment settlements for several borrowers at once.